Dear Advice for the Lovelorn:

I'm a 20-something backyard swimming pool who is, shall we say, starting to show her age. My plaster etches. My tiles are loose. And I can't cope with my coping anymore. I would love to get a makeover, but I'm afraid the other pools in the neighborhood will find out. What can I do?

—Brokenhearted in the Backyard

Dear Broken:

Don't be so late to the party. Haven't you heard? All the pools are getting makeovers these days, including your neighbors.

"BROKENHEARTED" IS RIGHT.

Last year, while some 80,000 new inground residential swimming pools were being built, over five times as many were being remodeled, often at a cost comparable to that of a new pool. Yes, Ms. Brokenhearted, remodeling has become a big business. And to find out exactly how big, Pkdata recently completed a survey of pool builders across the country. Here are five takeaways from that research.

1. Pools are getting older

One of the reasons the remodel market is growing is because pools are getting older. Back in 2004, when we asked owners about the age of their pool, the average was 18.1 years. Today it is 20.2 years. Why? Because we are building fewer new pools today than before the last recession. Those 80,000 new pools are less than half the number in 2005.

2. More builders are getting into the game

Table 1. Leading pool remodel projects1. Resurface gunite 64.0% |

Something else that appears to have changed is the percentage of builders who do remodeling. Before the recession, fewer than 50% of pool builders accepted such projects. According to our current survey, more than 85% say they do remodeling. In fact, many builders owe their existence to the category: By our estimates, the recession drove nearly one in four builders out of business. Many of those that survived did so because of remodeling opportunities.

RELATED: Makeover Magic

3. Renovations are good for business

A few other factoids: According to our survey, pool renovation as a percent of total builder revenue is now 21.2%. Two-thirds of builders say that their renovation revenue has increased over the past 3-5 years. The average number of annual renovations per builder is now 32.5. The top three renovation projects: resurface gunite: 64%; replace decking/tile/coping: 59.3%; replace vinyl: 30.3%.

Click to enlarge

Click to enlarge

4. Over half of all pool renovations involved the replacement of at least one pad component

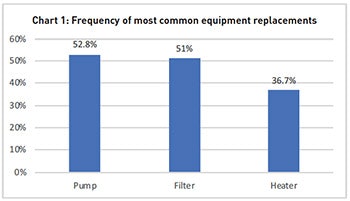

During a pool renovation project, builders will frequently recommend the replacement of a pump, filter, heater or other pad component. In some cases, the equipment may be nearing the end of its useful service life. Or, savvier installers may see a remodel as an opportunity to suggest an upgrade, such as swapping out a single-speed pump to a more efficient variable-speed pump. [See Chart 1]

5. Many remodel projects are the result of a home sale

Over a third of all pool renovations are done in conjunction with the sale or purchase of an existing residence. In most cases it is the purchaser that requests the work, either as a condition of the sale (such as repairs suggested by an inspector) or once the buyers get settled into their new surroundings. Note to builders: Start keeping an eye on Zillow or other real estate sites for recent transactions involving homes with pools.

Click to enlarge

Click to enlarge

SMALLER YARDS, SMALLER POOLS

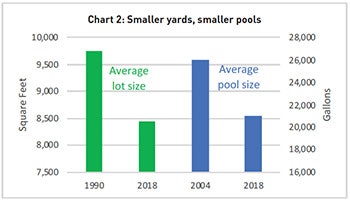

Another trend that is emerging in our builder research concerns the shift to smaller inground pools. Over the past 15 years, the average pool size has decreased from 26,000 gallons to 21,000, a decline of nearly 20%.

RELATED: Vinyl Liner Pool Gets Extreme Makeover

Part of the reason could be smaller backyards. According to census data, the average residential lot size in this country is now 8,450 square feet, down from 9,750 in 1990. That's about three swimming pools of lost property. [See Chart 2]

Even though pool sizes are shrinking, the average cost of a new pool has begun to climb again. Recent pool prices hit their nadir in 2009, during the depths of the recession, at $38,400 (2019 adjusted) compared with $45,000 today. In real terms, the price of a new inground residential pool has increased from $1.23/gallon ten years ago to $2.14 in 2018. To be fair, backyard pools today are now more amenitized with add-ons like attached spas, accent lighting and automation.

Click to enlarge

Click to enlarge

AND NOW THE BAD NEWS

But proving once again that every silver lining has a cloud, we should also share a somewhat more disturbing trend: More pools are being removed from backyards.

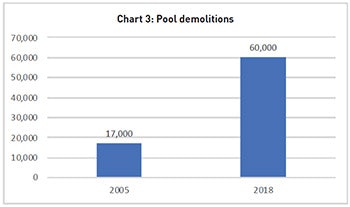

Pkdata estimates that in 2018 nearly 60,000 inground pools were decommissioned, over three times as many as in 2005. Again, the aging of the pool stock is the major reason why. In our builder survey we discovered that 45.2% of respondents accept projects to take pools out of service, either demolition or fill-in. Average costs for decommissioning depended on the type and size of the pool but generally ranged from $7,000 to nearly $20,000.

[See Chart 3]

This is a dangerous trend. If the demolition rate continues, and the current lethargy continues with new pool construction, we estimate that pools subtracted will soon surpass new pools added, thus having a deleterious effect on the existing base.

So, while the booming renovation makeover market is always good news, we also need to see a hotter market for new backyard pools. Otherwise some of those backyard broken hearts may instead become broken concrete.