Inflation touches everyone. The current wave of price increases at the gas pump, grocery store and everywhere else erodes consumer confidence, drains pocketbooks, pressurizes the housing market, and festers widespread anxiety. Virtually no one is immune.

Contractors working on long-term projects are facing a particular type of cost-escalation challenge, one driven by skyrocketing material, fuel and labor costs. That’s particularly true in pool construction, where the white-hot market of the past two years has forced many to schedule installations months in advance, or longer.

The hitch is that between the time a builder signs a contract — and then breaks ground months later — prices will inevitably go up. That means either they or the client are forced to absorb the cost in the form of reduced margins or an increased project price.

Today’s furious inflation rate coupled with attenuated scheduling have, without doubt, dramatically exacerbated that problem for pool builders nationwide. In what might be described as more normal times with greater price stability and shorter construction lead times, builders could factor in expected annual increases, which have been typically announced in the first quarter and fall in the 5 to 7% range.

For the time being, that predictability has been obliterated.

UNIVERSAL SQUEEZE

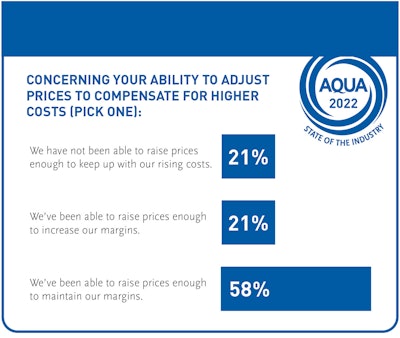

Price increases across the board — from basic building materials, to pool and spa equipment — have doubled or tripled normal escalation. And, worse yet, those increases are happening year-round in some product categories, sometimes with little or even no notice.

The impact is being felt at all levels of the pool-building sector, from volume builders to high-end custom firms, and across all types of pools, from concrete to fiberglass, stainless steel and vinyl, residential and commercial, and across the country.

Clearly the squeeze is on, and everyone is feeling the pinch.

“We’ve never seen anything like this, literally everything has gone up in price,” says David Owens, owner of Owens Custom Pools in Eugene, Ore. A builder of shotcrete, vinyl-liner and hybrid stainless steel pools, Owens sees the impact across all of his project types, with basic construction material pricing being the most impacted.

“Probably the biggest increases we’ve seen are for electrical conduit and PVC pipe,” he says. “On a basic pool, we used to spend around $1,600 on plumbing, now it’s $3,300. Last year, we lost a lot of our profit for similar things that we didn’t account for, because in the past, we had never seen increases at that level.”

Given the very nature of pool construction, slashed margins are not surprising when prices soar, says Paolo Benedetti, owner of Aquatic Technology Pool & Spa in Morgan Hill, Calif. “The business model in the pool industry where you give the client a fixed cost, but then don’t start the project for three months and then finish it three months after that, that really opens the builder to eating price increases, whether that’s coming from your product suppliers or your subcontractors. My project usually takes more than a year, so the problem is even more pronounced.”

The widespread increases for all types of material and equipment aggravates the problem because all budgets and bids become moving targets. “PVC has exploded in price,” says Benedetti. “Steel and all types of equipment, filters, pumps, heaters, all of that has gone through the roof. The same is true of installation materials like tile-setting products. Lumber has almost tripled in price. It was maybe four or five times the price, but did come down somewhat, but the price is still sky high.

“A lot of it comes down to energy costs,” he adds, “which is affecting every part of the supply chain. And excavators are paying much more to keep their machines running all day. Over the past two years, there’s no doubt that the pandemic had a major impact, as well. It’s been something like a perfect storm.”

Dave Penton, owner of Fluid Dynamics in Fullerton, Calif., adds that increases have affected the overall cost of doing business, beyond direct construction-related costs. “Our rent is going up, electrical, everything is going up. And so, across the board, we’re really paying attention to the books and just making sure that we are trying to stay in front of it. But I don’t see any area that inflation is not affecting at this moment in time. In fact, I can’t think of anything that’s stayed flat.”

When asked if his company has had to “eat” price increases in the past, Penton simply responds, “Yes.”

PASSING IT ON

As a result, Penton reports that his pricing has increased by approximately 30% in order to accommodate the almost frenzied price escalation. “We’ve never raised prices that much,” he says. “I was recently sitting down with my accountant, crunching some numbers, and he wondered if that was enough because the margins are coming back down again. So, we may actually even be seeing another price increase coming up here, probably I would think in Q2.”

Because no one is in business to lose money, the immediate concern is how to pass along the cost increase without alienating clients. “It’s hard to price these projects and then stick to a price,” says Steve Kenny, owner of SRK Pool Services in Wainscott. N.Y. “We have to let people know there are upcharges, and it doesn’t go over so well, to say the least. But we don’t have a crystal ball, so we can’t really see what’s going to change and what’s not. At the time of installation, we have to adjust our pricing.”

Establishing client expectations for price escalation from the start is the key to justifying subsequent increases, Owens says. “We changed our contracts so that if we experience a price increase, we send the information from the manufacturer to our customers. Before we did have to eat the increase, and I realized that you have to anticipate a significant increase, especially now.

“Clients mostly understand because everyone is experiencing the same thing,” he adds. “We do tell them that the price will probably go up, and we also let them know that there could be things we just can’t get in time — which is another side of the problem, the delays in the supply chain. Last year, we waited six months for an autocover track due to shortages and price increases in aluminum.”

“What we have found is that the clients are definitely questioning it,” adds Penton, “but we just tell them, ‘Look around. Everything is suffering.’ We haven’t had too much pushback from clients. It is what it is. I think that one of the surprising things is that, in years past, there was more of a pushback from clients when prices went up. But based on the news media and everything, I think everybody understands that prices are going up significantly right now. So it seems like we’re getting less pushback than we have in years past.”

GOING COST-PLUS

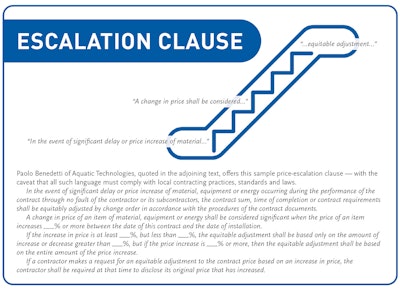

Including “escalation clause” language in contracts is a ready and logical solution for many builders, one that does require clarity when communicating with clients early on the life of the project, and transparency later on when the increase hits.

“We’ve had to admit that we’ve had some increased cost,” says Kenny, “and we’re going to have to unfortunately pass along the increase. We make sure they know we aren’t marking it up and charging them. We’re just making sure we break even. I’ll reevaluate the project as to where we’re at in the project. If things have happened already, we’re obviously not going to readjust that contract from there, but anything moving forward that comes in, we’ll have them help us with the rate increase.”

For his part, Benedetti offers clients an alternative solution, one that is favored by many of his highend clients. “Most of my projects are on a cost-plus basis,” he explains. “In the current economy, it’s easier to sell projects on a cost-plus basis than it has been in the past. If I don’t, I’m going to pad the contract with extra margin so I don’t lose money, and that might turn out to be detrimental to the client.”

“It’s like working with a custom home builder,” he adds. “We start with a spreadsheet with a budget for all the major phases. We send out plans to the excavator, the steel crew, the shotcrete company and so on. Everybody bids on the plan, and we plug those numbers into the budget. There’s certainly a trust issue involved, which is why I operate on an openbook policy. We show the homeowner exactly where the price has increased. They can see what the cost is and what our margins are. That’s exactly how custom home builders do it on high-end projects. The margins, the overhead rate, is all based on the actual costs, and it’s completely transparent.”

For fixed-price projects, Benedetti insists on escalation language in his contracts, which he believes should be standard for all types of builders. “I think the lower end of the market is always going to be a fixed-price situation. But they should include price escalation in their contracts. That’s going to be palatable to most consumers. Unless they’ve been living off the grid somewhere, everyone is aware of inflation, because we’re all affected by it.”

He adds that purchasing habits of volume builders lends itself to fixed-cost contracts. “Volume builders take advantage of early buys and can develop inventory,” he says. “That’s not necessarily the case with custom builders. We are more susceptible to these mid-year increases because we don’t stock large quantities of equipment and materials. There are carrying costs that go along with that inventory, so it doesn’t make sense when you build a small number of high-end pools. The cost-plus basis enables you to cover those increases.”

INVENTORY MANAGEMENT

Facing price-increasing headwinds has meant making changes in purchasing habits, especially when it comes to maintaining inventory of commonly used products.

“I don’t work off negative inventory anymore. That’s a thing of the past,” says Kenny. “I think in the past, we’d be able to work off negative inventory and lean on the vendors to actually hold products for us until we need it. But now, it’s at the point where you can’t do that anymore, so you have to bring in a lot of inventory to satisfy the need, and not rely so much on the negative inventory approach.

“I stockpile stuff six months ahead of time and hold the inventory the best I can. I have to have the product on hand when I need it. We do service construction and renovation. That means we have to carry products so that when something fails, we have to be able to jump on it. We can’t tell people that we can’t get a heater, or we can’t get a filter, or we can’t get a pump.”

“When you stock products,” adds Benedetti, “you have to consider the carrying cost of maintaining that inventory. You’re carrying the cost of purchasing the products, as well as storage, insurance and other factors.”

“We have inventoried a lot more in the last year than we ever have in 25 years,” Penton says, “but it’s more a supply-chain hedge than it is bulk material or bulk pricing. I want to make sure that I have what I need when I need it. And so, yeah, we have probably four times the inventory we’ve ever had in our history. And now, we are preordering equipment a lot more, just parts and pieces we’re inventorying that we never had in the past.”

“We actually just reconfigured our warehouse and bought a whole bunch of more pallet racks,” he adds. “Whereas we had single-level racking previously, now we’re all the way up to the ceiling, and we’re utilizing the space that we have much more broadly.”

DEMAND AND SUPPLY

As to whether or not to look for alternative products, the builders quoted here all said that because prices are going up en masse, there’s little benefit to shopping for less expensive, and sometimes inferior, products.

“I’m not going to switch automatic covers, for example, because I love the brand we’re using,” says Owens. “When you start jumping around to other suppliers, you can wind up in the exact same situation with prices going up and no availability. Everybody faces the same issues.”

Penton agrees, adding that maintaining vendor relations is crucial, no matter the market conditions. “I’m pretty brand loyal,” he says, “especially in this time of volatility. I do know that, with the volatility, I can run into delays getting equipment. If I’m not loyal, I’m less likely to get loyalty from the suppliers in return. So that is the one area where we have stayed the course. Because if I have an emergency and I need something, I know that I can call my rep and say, ‘Hey, can you do me a favor? I need one pump to finish this job.’ If he knows that I’ve gone out and bought from other manufacturers, he’s going to be a whole lot less likely to help me out.”

In the longer view, whether or not elevated pricing will cut into current high demand remains an open question, but for builders with extensive project backlogs, it could be a long time before any decrease in consumer interest touches their businesses.

“I don’t see demand changing, at least not for now,” says Owens. “We’re already booked out a year and a half in some cases. When you’re that far out in scheduling, there is no question prices will go up, it’s just a matter of how much. Even with that, we’ve seen no slow down in interest — the phone keeps ringing.”

Penton takes a different view, suspecting that at some point, elevated pricing will cut into consumer’s willingness, and/or ability to pay. “I can’t see how it’s not going to,” he says. “I’m shocked, quite honestly, just because the numbers are so big. In Southern California, prices tend to be high here anyway. But even some of the big volume builders around here, their base pool is getting up close to $100,000. And that’s just . . . I know I can’t afford that. So, to me, I feel like at some point it’s going to. I don’t know. I’ve been saying this for a while.”

A special thank you to Matthew Batiste Naylor, owner of Architectural Blue, a custom builder in Palm Springs, Calif., for first suggesting we pursue this topic.

This article first appeared in the May 2022 issue of AQUA Magazine — the top resource for retailers, builders and service pros in the pool and spa industry. Subscriptions to the print magazine are free to all industry professionals. Click here to subscribe.