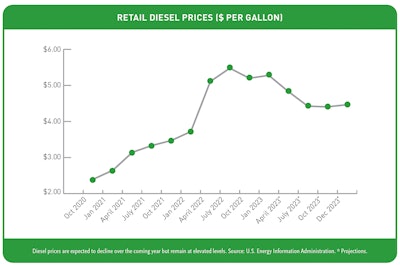

For pool construction companies struggling to keep costs down, diesel fuel price relief can't come soon enough. The distillate fuel oil was selling for a historic high of $5.75 a gallon this past summer, more than double the $2.40 level of two years earlier, dragging down profitability for builders who rely on it.

Prices have since moderated, declining to $5.21 by late 2022, and more relief is on the way. The U.S. Energy Information Administration projects a price dip to $4.41 by the fall of 2023.

One reason for the price moderation is a decline in the panic-buying that occurred in the initial months of the Russia-Ukraine war. Another is a move by refineries to retool their operations for greater diesel capacity. Another third is a general deceleration in the global economy, which results in declining demand.

THE COSTS OF WAR

While diesel prices have moderated, they remain sky high by historical standards. Price estimates for the fall of 2023 remain some 47% above typical pre-pandemic levels (see chart on page 68). And there's no disagreement about the primary reason. "Diesel prices are elevated right now largely because of the Russia-Ukraine war," says Clark Williams-Derry, an analyst at the Institute for Energy Economics and Financial Analysis. "What's happening in Russia is affecting global energy markets in a very deep and profound way."

Russia produces about 10% of the oil from which the world refines diesel. Europe is especially dependent on Russia for its supply. "The war has disrupted the European market, either completely eliminating it or dramatically reducing it," says Allen Schaeffer, executive director, Diesel Technology Forum. "That means that folks in Europe and other countries that might have done business with Russia in the past are now scrambling to find fuel in other places." Spooked by disruptions in natural gas deliveries from Russia, Europe is also stockpiling diesel in case it's needed for home heating this winter.

Europe's increasing demand for diesel affects prices everywhere, given the commodity status of oil and its distillates. "One nation's demand affects everyone," says Schaeffer. "We are seeing a whole trickle-down scenario as more people try to use a product that has become less available."

The global nature of diesel is responsible for its elevated pricing in the United States, despite the nation's export of roughly one million barrels of the distillate every day. "The U.S. is a net exporter of oil and petroleum products but is still as dependent and as vulnerable as ever to global market forces," says Williams-Derry. "We don't get a cheaper price just because we are producing more oil or because we have a lot of refinery capacity. We pay the same price as anyone else who is avoiding Russian oil."

UPWARD PRESSURES

While the Ukraine war is the major driver of higher diesel costs, it's not the only one. "A number of factors have put upward pressure on retail prices," says Andrew M. Lipow, president of Houston- based Lipow Oil Associates. "One is the post-pandemic reopening of economies around the world." People are traveling more and that means greater demand for the jet fuel, which pulls from the same oil resources required for diesel. And more fuel is needed for the greater number of trucks delivering capital goods and consumer merchandise.

The rebound in global demand is happening at a time when many refineries have cut back production or closed. "We don't have as much capacity to produce diesel fuel today as we did pre-pandemic," says Schaeffer. "COVID caused a lot of layoffs at refineries around the world. It also caused a delay in the startup of new refining capacity which would have increased supply."

The U.S. possesses some specific additional drivers of fuel prices. "For the last few years, even before the Russian crisis, diesel has sold at a premium to gasoline in the U.S.," says Williams- Derry. "One reason is higher federal and state taxation. Another is the shift to lower sulfur diesel. That's been very good for clean air but has also slightly increased the price of diesel relative to gasoline."

LOW INVENTORIES

The fact that distillate inventory is running low around the world has only added to upward pricing pressure. "As economies have recovered, the supply of crude hasn't kept up with demand," says Lipow. "For all intents and purposes, diesel levels are the lowest they'd been since 1951. The world has been living on borrowed time, if you will, by drawing down inventories."

Diesel supplies are tight in most of the regions of the United States. Nationally, inventory supply has been running at 25 days, down from its normal 30 to 35 day level. Of particular concern is the East Coast, a region with high population centers, high heating oil demands, and a lack of refining capacity. In late 2022, the region had only 13 days' supply of diesel, down from 26 a year earlier. One exception to the trend is the Gulf Coast with its robust refining capacity and limited requirement for home heating.

In a perfectly fluid market, one would expect dwindling inventories and growing demand to stimulate higher production at the world's refineries. Yet there are roadblocks, one of which is a carry-over from the worst days of the pandemic. "At the peak of the pandemic in 2020, diesel demand had gone down by 30%, and refineries were losing tons of money," says Lipow. "At the same time, they were getting older. In the United States, they were also facing more environmental restrictions, especially in California."

Refinery operators were put on the spot as the pandemic softened demand for their products and the Biden administration moved away from fossil fuels. "Suppose you're looking at spending several hundreds of millions of dollars, perhaps even a billion dollars, to comply with new environmental regulations," noted Lipow. "In an environment where the demand for your product is going down, you may well decide to simply shut down."

The slim levels of diesel inventory leave the market vulnerable to unexpected shocks. "All you need is one little hiccup in the supply chain or a problem with a pipeline or a big cold snap in the Northeast," says Schaeffer. "The next thing you know, higher prices and shortages are back in the news."

GROWING CAPACITY

Not all is doom and gloom in the energy picture. Despite the cost and the delays required for creating new refineries or upgrading older ones, some new capacity is coming on stream in the first half of 2023. "Kuwait and Oman are building brand-new, large refineries," says Lipow. "Two new refineries have just come on stream in China. And we've got another large refinery coming on stream in Nigeria. Closer to home, Mexico is building a new refinery, known as Dos Bocas, coming online in the next couple of years." Lipow figures these new refineries will produce some 2 million barrels a day, equivalent to about a 1.5 to 2% increase in world refining capacity. Another contributor to an increase in diesel supply is the green energy movement. "We are seeing a tremendous growth in investments to produce biodiesel and renewable diesel," says Schaeffer. "Having more renewable biofuels helps not just keep the price down, but also helps with more available supply."

Major oil refiners jumping onto the green bandwagon include Phillips 66, Marathon Petroleum, and Chevron. All are investing in new refining capacity or transitioning older petroleum operations to make more renewable diesel. Other companies, such as Marathon and Diamond Green Diesel, are joining the effort. All told, the past year has seen the production of 3.2 billion gallons of green diesel, about two thirds of which was biodiesel. Schaeffer figures that by 2030, production should top 15 billion gallons.

SLOWING ECONOMIES

Diesel fuel makes up a significant portion of the variable costs in a construction project, and in the last year, those costs have typically doubled. It follows that the price moderation forecast for the coming months will come as a relief. "We feel like we've hit the ceiling now and are going to be settling down over the next six months," says Schaeffer. "We will still be paying a higher rate for diesel than we've been accustomed to. But it won't be as high as where we are now."

Even so, uncertainties in the global operating environment mean that the future of diesel availability and pricing will depend largely on the answers to some open questions. How will the world deal with and recover from the Ukraine war? How will Europe handle the shock of a drop in oil supply? Will sanctions and tensions escalate, or will Russia experience an internal political shift and reach an accommodation?

"If you're trying to predict what's going to happen in fuel markets, this is a particularly unusual time," says Williams- Derry. "It's not just about supply and demand. It's also about politics."

This article first appeared in the March 2023 issue of AQUA Magazine — the top resource for retailers, builders and service pros in the pool and spa industry. Subscriptions to the print magazine are free to all industry professionals. Click here to subscribe.