While we are stuck at home waiting for our vaccination shots, it seems the pool and spa industry was the first to get a real injection. It would come in the form of a surge in demand for residential pool construction. With millions of Americans working from home, many of them with more disposable income than ever, demand for pools (and practically all elements of the outdoor lifestyle) skyrocketed. Some builders reported a 400% increase in leads from the year before.

However, it was not all sunshine and lollipops. Pool builders had a difficult time keeping up with the blistering demand. New pool construction could have been even greater if it wasn't for huge logistics issues. Pool construction companies couldn't supply the insane amount of demand due to new inventory not arriving on time and staff being unable to work due to the lockdown.

Sales could have been significantly higher if additional industry infrastructure, such as a skilled labor force and materials, was in place.

"Builders had orders to construct many more pools but could not do so," says Jerry Kisgen, executive director of Pkdata's Pool and Spa Division. "Overall, the industry could have sold thousands of more pools if the equipment and raw material supplies were available and a skilled labor force was in place to accommodate the demand. Builders received more construction inquiries than they could respond to and the supply of aboveground pools quickly sold out."

And this wasn't only for new pool construction. Other parts of the industry certainly felt the effects, too, he adds. "The demand for retail products, including equipment, chemicals, grills, outdoor furniture, etc., was extremely high. Many consumers who were homebound were focused on adding and improving products to their backyards. Most retailers experienced a sales increase of over 50% for certain products. The overall shortage of some of these products curtailed the sales that could have been much higher. To achieve these high sales volumes, though, many companies had to develop home delivery and curbside pickup programs."

Indeed, pool and spa companies adapted to the draconian new circumstances in spectacular fashion. According to AQUA's State of the Industry builder survey, over 80% of builders changed major components of their business models in response to the pandemic, including systems for handling and qualifying leads, customers interaction, their own employees (due to all the elements of COVID stress, including the effects on family life), and especially, logistics and supplies for the jobsite.

RELATED: Retail Forecast 2021

It was the nimble response to huge new logistics problems that enabled the high level of pool construction (hampered as it was) seen in 2020. These problems have continued, or in some cases worsened in 2021, putting the growth in completed projects, commensurate with the growth in demand, at risk.

"The main issues constraining pool construction in 2021 include shortage and rising costs of raw materials, equipment, labor and shipping," says Kisgen. "Freight costs are soaring globally, increasing from $1,040 last June to $4,570 on March 1 per container, according to S&P Global Platts. Many manufacturers are reporting significant raw material cost increases along with massive shortages and delays in receiving material orders. Many manufacturers have passed on these price increases to their customer base with revised price lists going out since the first of the year."

So how are businesses compensating for this increase in the cost of trafficking essential materials? By increasing the value of swimming pools. Our 2020 Residential Pool Report shows a 12% increase in the cost of pools from 2019 to 2020.

"Early in the pandemic, builders were somewhat tentative with raising their prices," says Kisgen. "However, seeing consumers accepting price increases without argument changed that reticence. Most consumers were far more focused on when construction could begin and finish versus negotiating the price."

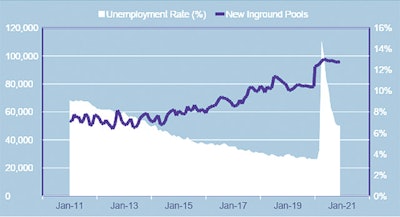

There are certainly other interesting numbers to consider with the rise in demand that contradict previous studies. Take the unemployment rate, for example. While unemployment generally has a reverse correlation to new inground pool construction, the spike in initial unemployment at the beginning of the crisis positively correlated with the spike in demand. Look at CHART 1 below for reference.

CHART 1: Source: Bureau of Labor Statistics ((Seas) Unemployment Rate); Pkdata

CHART 1: Source: Bureau of Labor Statistics ((Seas) Unemployment Rate); Pkdata

This is something that pool builders should keep in mind if there is ever a massive increase in furloughs like we saw in 2020.

![CHART 2: Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, February 28, 2021; Pkdata](https://img.aquamagazine.com/files/base/abmedia/all/image/2021/05/aqua.Retail_Review_Forecast_Chart2_521_sm.png?auto=format%2Ccompress&fit=max&q=70&w=400) CHART 2: Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, February 28, 2021; Pkdata

CHART 2: Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, February 28, 2021; Pkdata

Another strange reverse in trends affected by the pandemic is Consumer Confidence Sentiment, shown above (in CHART 2) superimposed on the rate of completed inground pools.

Strange, huh? Look at CHART 3 and 4 below to see a similar negative correlation between Single Family Housing Starts, Real Personal Consumption Expenditures Per Capita and New Inground Pool Construction.

How about those lovely stimulus checks issued by our government? Well, according to the chart below, construction numbers did not seem to go up with the excess in spending that began around the time the checks started flowing in. However, with the latest stimulus check deposited (and rumors of a future fourth check in waiting) there are plenty of reasons for new pool construction demands.

![CHART 3: Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, February 28, 2021; Pkdata](https://img.aquamagazine.com/files/base/abmedia/all/image/2021/05/aqua.Retail_Review_Forecast_Chart3_521_sm.png?auto=format%2Ccompress&fit=max&q=70&w=400) CHART 3: Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, February 28, 2021; Pkdata

CHART 3: Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, February 28, 2021; Pkdata

![CHART 4: Source: U.S. Bureau of Economic Analysis, Real personal consumption expenditures per capita [A794RX0Q048SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A794RX0Q048SBEA, February 28, 2021; Pkdata.](https://img.aquamagazine.com/files/base/abmedia/all/image/2021/05/aqua.Retail_Review_Forecast_Chart4_521_sm.png?auto=format%2Ccompress&fit=max&q=70&w=400) CHART 4: Source: U.S. Bureau of Economic Analysis, Real personal consumption expenditures per capita [A794RX0Q048SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A794RX0Q048SBEA, February 28, 2021; Pkdata.

CHART 4: Source: U.S. Bureau of Economic Analysis, Real personal consumption expenditures per capita [A794RX0Q048SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A794RX0Q048SBEA, February 28, 2021; Pkdata.

FORECAST

So let's get to the important question: Will the increase in demand continue over the next few years? For that, I will turn it over to former CEO Bil Kennedy, may he rest in peace, for the next piece. In an article he wrote for the August issue of AQUA in 2018, he accurately predicted the numbers that we are seeing for new construction numbers for 2020 and beyond. (I did not find

a crystal ball when going through his stuff, so did he just know something that we didn't? Or was the industry always meant to shift back to the 100k+ new construction numbers we were always meant to return to?)

RELATED: Hammering it Home: COVID-19 Fails to Derail Renovation Plans

In short, the outlook for pool building is good up through the middle of the decade, says Anne Duma, senior analyst at Pkdata. "Barring any further major unforeseen circumstances, the forecast for new pool construction for the next five years (2021 – 2025) is favorable. While sales growth will slow, we project continued annual growth in new units with an average growth rate of about 3% per year. Volume over the next two years will be robust, supported by pent-up demand before starting to level off through 2025."

Of course, as the pandemic itself made clear, forecasting is very risky, especially in the pool industry. Who could have predicted a pandemic would revive the pool business? Weather, natural disasters and the economy can significantly impact pool construction during any year.

The strong demand and permitting of new pools have continued into 2021. Many builders are fully engaged with projects through the end of this year. While we believe growth will not continue at this breakneck pace, we find the renewed interest and focus on home improvement will continue as many families realize the value of investing and improving their surroundings as they spend more time at home.

"Over the next two years, we believe the sales volume will be robust, supported by pent-up demand, before leveling off through 2025," adds Kisgen. "Barring any other significant unforeseen circumstances, the forecast for new pool construction for the next five years is favorable. While sales growth will slow, we project continued annual expansion in new units with an average growth rate of about 3% per year. The net result shows new pool units will be 40% greater than 2019, the year before the pandemic."

CONCLUSION

Due to the vaccine, we will certainly see a gradual shift back to the office, and people will spend less time at home. With fewer eyes focused on their homes, we don't expect demand to be as high in the following years as it was in 2020. However, recent polls have shown that a sizeable portion of workers would prefer to remain working at home. The government has taken notice, and businesses are adapting to this culture, so we may continue to see a fair portion of the U.S. workforce continue to work from home offices. This is great news for anyone in the industry of home improvement and a sign of future success.

If supply is able to meet demand, we could potentially have higher numbers of pools constructed this year relative to our success in 2020.

RELATED: Tips for Managing Your Pool Business in 2021

Nobody would call 2020 a good year, by any means. It was a year that was marked by tragic loss (including my father and former Pkdata CEO Bil Kennedy). However, alongside the bereavement and destruction of the pandemic, a nation discovered a new passion for the backyard.

For those wishing to have more information on the matter, feel free to check out Pkdata's latest Residential Pool Report (released in March of this year) or contact us for your personal consultation needs. Our services provide in-depth statistics backing up the info released in this article and help guide your business to a better future. Info can be found here.

Max Kennedy and Jerry Kisgen are CEO and executive director of Pkdata, an Atlanta research and consulting firm that has tracked the swimming pool and hot tub industry since 1992. The firm provides market guidance to leading pool and spa products manufacturers, retailers, and builders in the U.S. and globally.

This article first appeared in the May 2021 issue of AQUA Magazine — the top resource for retailers, builders and service pros in the pool and spa industry. Subscriptions to the print magazine are free to all industry professionals. Click here to subscribe.