Bil Kennedy is president of P.K. Data, an Atlanta research firm that has tracked the swimming pool and hot tub industry since 1992. The firm provides market guidance to leading pool and spa products manufacturers, retailers and builders in the U.S. and abroad, and also serves as counsel to the industry’s trade organizations.

For the past 22 years, P.K. Data has tracked and reported on the vicissitudes of the pool and spa industry. In conducting over 400 studies we have interviewed thousands of pool and hot tub dealers, distributors, manufacturers and other stakeholders. We have probably talked with 25,000 pool and hot tub owners about their shopping habits, product usage and brand awareness. We have reported on new technologies, advised on venture funding and evaluated opportunities in overseas markets. And over all of that time we have offered many conclusions, recommendations and summary judgments. But we have never, ever said anything like the following:

This year is critical to the future of the swimming pool and spa industry.

As researchers, we deal in facts rather than generalities. Facts like these: Since 2009 (the officially declared end of the recession), household net worth — a key measure of consumers’ ability to spend on discretionary items like swimming pools — has increased 36.5 percent. A major influence has been a 64.8 percent increase in the Dow Jones industrial average.

Over that same period, home prices have increased 32.4 percent. (Upturns in key pool markets have been as much as double that rate.)

Similarly, new home sales have increased 22.8 percent.

The number of lenders willing to accept consumer installment loans is up 68.1 percent.

On the other hand: Since 2009, total growth of new pool construction has only been 2.5 percent.

Over that same period, hot tub sales growth has been an equally listless 1.9 percent.

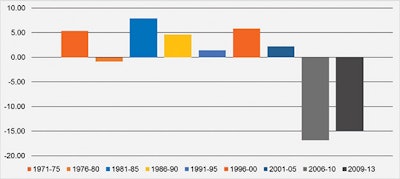

Not only does new pool construction lag the economy, it even lags itself. The chart above compares new pool growth over five-year intervals from 1970 to 2013.

No matter how you cut it, the pool/spa industry is not keeping up.

The question becomes, at what point does the economy stop being the enemy? Is this the time to reflect on the words of the cartoon character Pogo, who once said, “We have met the enemy and he is us?”

Currently, about 8 percent of U.S. households have a backyard swimming pool (in- or aboveground). P.K. Data has run numerous analyses to gauge the category potential, namely, the total number of households that can realistically be expected to own a swimming pool. After accounting for income, dwelling type, family characteristics, climate, etc., we believe that 20 million households is the reasonable upper limit for pool ownership. That translates to an additional market of 13 million households, 45 percent of which should be prime candidates for an inground pool. In other words, about 6 million potential pools. During the pool industry’s peak in the mid-2000’s, builders were installing some 180,000 pools per year. That means that we still have potential demand for about 33 really good years (6 million divided by 188,000). Note that this calculation ignores population changes and other econometric variables. The market could be even greater by 2047.

So what are we doing chugging along at 50,000 pools/year?

Answer: Nothing. And that’s the problem.

Case in point: One of the key metrics of any industry’s viability is the degree to which it promotes to the end user. A common measure is something called the advertising-to-sales ratio. Leaders tend to be categories like beer and soft drinks, where collective advertising budgets as a percentage of revenue are usually in the teens. At a more comparable level, the sporting goods industry typically devotes 5 to 7 percent of revenues to advertising; boats are in the 4 to 6 percent range; recreational vehicles 3 to 6 percent. Based on P.K. Data estimates going back 20 years, the swimming pool industry has averaged less than one percent. Nike spends more on advertising to the consumer in the U.S. in 48 hours than the swimming pool industry does in a year.

Yes, you say, and Nike is a huge brand with big name endorsers and a global following. But try to remember that the Nike brand didn’t even exist before 1970. The pool industry had already been around for twenty years by that time.

Next time you are at a party, ask people to name three brands of beer, or soft drinks, or sporting goods. Then ask them to tell you how they would spend $50,000 if it was given to them and see how long you have to wait until you hear the words “swimming pool.”

Unit sales of new inground residential swimming pools in the U.S., 2001-2013. (Note: 2013 = estimate.)

This chart shows the decline in new inground pool sales since 2001. We have dropped a long way since those halcyon days of just a few years ago. So if the economy is really turning around, and we’re not, it begs the question: Is this the new normal? We are frequently asked when we expect a return to the good old days. If the industry is going to return to its former glory it had better start soon.

Crunch Time

So what makes this year so important?

At last, all of the pieces are in place for a strong pool selling season. For one thing, the economy is becoming more robust. Recent surveys of leading economists in government, on Wall Street and within corporations have resulted in an unusual consensus to the effect that 2014 should be strong on all counts. What’s more, it would seem that the weather may be on our side as well. The Old Farmer’s Almanac sees warmer-than-average temperatures in key pool construction markets throughout the country, with at- or below-average precipitation. (The Old Farmer’s Almanac, by the way, has historically registered an 80 percent accuracy rate on its long-range forecasts.)

So no excuses this time. This is the year to break through the lethargy. But to do that we have to first break through the consumer’s zone of consideration. To put a fine point on that, consider the following.

Inground pool construction recovery scenarios.

In this exhibit we envision three different growth scenarios leading to a restoration of 180,000 new inground pools/year. You can plainly see what’s at stake. If the industry were to suddenly spring to life and start installing new pools at a 15 percent/year growth rate, it would take approximately eight years to pick up where we left off in 2005. Unfortunately the industry has never seen a sustained growth rate of 15 percent. During its most recent ramp-up from the mid-1990’s to 2005, the average was 5 to 8 percent. At that level it would likely take until 2030 to get back on track.

Hopefully the lesson is becoming clear. You cannot lose over 70 percent of the retail value of your industry over a four-year period and expect to get it back all at once. And it may never come back if there isn’t a greater unity of purpose, specifically outreach to those other 13 million families that can and should be enjoying the pool lifestyle.

In 1997, we conducted a large, national survey of socio-economically qualified households who did not own a swimming pool. We followed that in 2004 and 2011 and the results were pretty much the same. In every case, “Had not thought about it” was the leading reason for not having a pool. And in all that time the industry’s percentage of sales devoted to consumer advertising remained below one percent.

Look at it this way: We estimate that the current annual revenue of the top 100 pool builders in the U.S. is roughly $900 million. A five percent allocation of sales to consumer advertising, right in line with other recreational categories, nets out to $45 million.

It is fashionable to compare the pool business to the boating industry, and in terms of big-ticket discretionary leisure purchases they are similar. The retail value of the marine industry is roughly three times the pool industry, according to their trade association’s most recent figures. Their post-recession recovery rate has been quite impressive. And based on data from Nielsen Media Research, we estimate that the boating industry currently spends around $240 million on consumer advertising. Given a 3:1 difference between our two industries, that suggests that we should be in the neighborhood of $80 million just to keep pace. Yet on average we estimate the pool industry consumer spend to be closer to $17 million. So $45 million would at least be a step in the right direction.

Today some 12 million households own a boat, 9 million households own a recreational vehicle and 5 million own an inground swimming pool. The three industries share a heritage dating back to the post-war boom of the 1950’s. Yet pools have not kept pace. That seriously needs to change.

This would be a good year to start.

Comments or thoughts on this article? Please e-mail [email protected].