The boating industry did it. The RV industry did it. The milk and vision industries did it, too. All have national campaigns designed to promote customer awareness of their products — and many in the pool and spa industry have long been envious.

This leads to a natural question: How did they do it? And what lessons might we take from their experience to guide us to the same goal?

To learn more, we spoke with Thom Dammrich, president of the National Marine Manufacturers Association, about how the boating industry pulled together a national marketing campaign that has boosted revenues for boat manufacturers and dealers alike.

Early Steps

Like the swimming pool and hot tub industries, a movement in the boating industry was a long time coming. There were those who thought it might always be just that — something always in the future, existing as an idea, supported by a lot of talk.

“The industry talked about a campaign to promote boating for 25 years,” Dammrich says. “Then in 2004, we had a chairman of NMMA who said, ‘You know, it may be the time we take another look at it and get serious about it.’”

It started with a major summit attended by the industry’s major players. All agreed a campaign needed to happen, but first, they needed to do research on their target market in order to create a tailored message that would stick.

“We did the research so we weren’t operating on people’s opinions on what we needed to do or their ideas of what would work. We had data,” Dammrich says.

To that end, the NMMA spent $100,000 to learn more about general attitudes toward boating, concerns about boat ownership and more. Instead of focusing on the different types of boats and their features, through this process the NMMA learned to hone in on the reasons people like being on the water.

“We ended up focusing on the benefits of boating,” Dammrich says. “Why do people go boating? They go boating to spend quality time with family and friends, to enjoy the outdoors, to go fishing, etc.”

Armed with that knowledge, the NMMA sought an ad agency to bring the idea to life through an ad campaign. But it wouldn’t come cheap. After hours of interviews and presentations, the NMMA settled on an ad agency. The cost for their services? One million dollars.

To raise that money, the NMMA issued a special assessment of its membership, totaling half of its annual dues.

“The board voted on it and approved it, and we sent everybody a bill mid-year for an additional amount,” Dammrich says. “It was mandatory to pay. A few people dropped out, but most paid it and we raised $1 million.”

With money in hand, the ad campaign was developed in a little more than six months. Afterward, the ad team came back with a complete plan for the campaign, as well as an estimate for what it would cost to implement: $12 million.

And that was just for a year’s worth of exposure. This raised another question: How should an organization raise $12 million from its members — and keep the funds coming in future years?

Funding

Luckily, the NMMA already had a funding committee in place dedicated to this issue. And the committee had a proposal. To raise money for the campaign, the boating industry would add a charge to the one item essential for most boats sold by association members: the engine.

There was just one question: Who would be the ones collecting (and charging) the extra fee — the manufacturers, the boat builders, or the dealers?

“Unfortunately, in our industry, the dealers are a highly fragmented group. There was no way we could figure out how to collect the money from the dealers,” Dammrich says. “The dealers just weren’t voluntarily going to cough up the money, so it had to be the manufacturers that took the lead. And the most common element on almost every boat, including the larger sailboats, is the engine, which is why we picked it. Plus there are just a few engine manufacturers, half a dozen, that sell 98 percent of the engines.”

The plan works in two ways. When an engine manufacturer ships a loose engine to a dealer, an extra charge is added for the Discover Boating campaign. This charge, Dammrich says, ranges from $1 on a small engine to $72 on a large engine. The engine manufacturer is responsible to pay the assessment on loose engines shipped to dealers.

Engine manufacturers also ship engines to boat builders, who install them in boats before sending them to dealers. In that case, the boat builder pays the assessment and remits that charge to the NMMA.

“It becomes a cost of doing business and each manufacturer decides how they handle this additional cost.” Dammrich says.

Of course, that was all easier to plan than to get everyone to do. All sides needed to be convinced this was a good idea.

“The chairman of the funding committee was a boat builder out in Indiana, he was a recognized industry leader who took a leadership role in talking with the engine companies and the boat builders and coming up with a plan to fund it that eventually, everyone agreed to,” Dammrich says. “They didn’t all like it, but they all said they could live with it.”

And, of course, there was the matter of manufacturers who could very easily drop out of the NMMA to avoid paying the fees.

“We said from the beginning, we’re never going to get 100 percent participation. If we could get 85 percent participation, we’d be thrilled. But we can’t worry about the freeloaders. Well, we ended up getting over 90 percent participation,” Dammrich says.

Launch

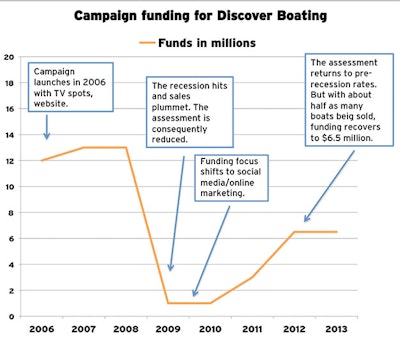

Discover Boating launched in 2006 with TV spots and a website. The ads promote the experiential aspects of boat ownership, including time with family and friends and the fun of fishing and waterskiing and whipping around a lake. The website is a comprehensive guide to all things boat ownership, from the differences between various boats to dealer locator tools and maintenance advice. The site also has the “boat selector tool,” an interactive feature that helps visitors find the perfect boat based on various factors, like price range, passenger load and intended use.

In 2007 and 2008, Discover Boating was able to increase its annual marketing budget to $13 million, a huge victory for the association and the movement.

But in 2009, the economy turned.

“Boat sales plummeted,” Dammrich says. “The decision was made to temporarily reduce the assessment during the recession, so our budget got cut to $1 million in 2009 and 2010.”

With a slashed budget, the strategy for Discover Boating evolved. While TV ads were left behind, Internet ads and social media tactics were employed with success. Now, Discover Boating has more than 665,000 Facebook fans with a reach of 140 million people. Four million people interact with the Facebook page every week.

With the industry climbing out of the recession, the budget for Discover Boating is once again blossoming; currently, the budget is at $6.5 million.

“We’re doing some advertising in movie theaters,” Dammrich says. “Now we’re talking about how can we double our budget so we can get back on television.”

Results

Discover Boating had one simple goal: to get people on a boat.

“Nobody goes out and buys a boat if they’ve never been on a boat. So the whole campaign was designed to get more people out on a boat, figuring that would lead to their own dream of boat ownership and eventually, they’d become boat owners,” Dammrich says.

Discover Boating launched in 2006. In 2007, the NMMA saw an increase in boating participation for the first time in a decade. And numbers have been rising every year since.

“One of our major members recently did some research, and their research concluded that the American public today gets it. They get what boating is all about and they understand the benefits. That’s not something you could’ve said before we did this campaign,” Dammrich says.

But with a little digging, the NMMA could see that some of the growth could be directly attributed to Discover Boating. In the early years of the campaign, the Discover Boating website collected names and addresses for lead purposes. Later, the NMMA compared that list to the lists of those who purchased a boat subsequent to their visit to DiscoverBoating.com — about 20,000 people who visited the website bought a boat within the next 12 to 24 months.

“And when you figure that the average boat owner buys three or four boats in their lifetime, those 20,000 new boat owners are worth hundreds and hundreds of millions of dollars of lifetime value to the industry,” Dammrich says.

Are We Next?

This story about the boating business contains many aspects readers will recognize in the pool and spa industry, both past and present — the traditional focus on products instead of benefits, the fragmented dealer base and the reluctance to share the burdens of a broad-based marketing effort, to name just a few.

Yet, unlike in the boating industry, the idea of a cooperative marketing effort in the recreational water industry remains a dream. For some, the frustration of failed past initiatives has produced a jaded mentality.

“We had the same thing,” Dammrich says. “We had a lot of frustrated dealers who wanted this to happen for a long time.”

However, he adds, it’s just a matter of making a move.

“We had a guy on our board who always used to lecture us about ‘taking the courage pill.’ You come to a point where you need to move forward and you’ve got to take a courage pill,” he says. “It just takes incredible leadership — the ability to make the right decisions and hope that the industry will follow. And my guess is, if the need to grow pool and spa sales is real, they will follow.”

Comments or thoughts on this article? Please e-mail [email protected].