Fifty-one percent of survey respondents saw sales increase in 2010, a big change over last year, when only 17 percent posted gains.

"Most people figured out that they were still employed and hadn't spent money in over a year," said one respondent that sold more spas last year than the year before.

Another executive echoed those sentiments: "Even though the economy is still questionable, people are stir crazy and want new stuff!"

Are these signs that even better days lie ahead? Seventy-nine percent of respondents think so, while only 5 in a hundred think they'll sell less in '11. Last year's survey-takers were similarly hopeful about 2010, and they proved to be prescient.

Unit sales of spas also appear to have steadied. One in three told us sales stayed even with 2009 levels, and an equal number saw sales growth. A year ago, fewer than one in 10 sold more than they had the year before, while sales were down for 46 percent of the group.

There was even more good news to be gleaned from the survey: The percentage of stores that laid off employees dropped from 38 percent on last year's survey to 28 percent on this year's. The employment outlook for 2011 is even better, as only 1.4 percent of survey respondents told us they planned to downsize. More are also planning to add sales staff and counter clerks this year, as nearly a third said they would bring back some of the positions they had eliminated in the past.

In addition to spending more on payrolls, retailers told us they planned to spend money educating those staffers (17 percent) and increase advertising expenditures (38 percent).

Other store executives told us of plans to remodel stores inside and out, add new items to the showroom floor and renegotiate leases to free up more capital.

Many, however, said they planned to get ahead by doing more with less.

"Employee education is an ongoing process — we are expending more time and effort on it than in the past, but not necessarily more money," said one respondent.

Demographics

The survey respondents, which comprise a mix of owners, presidents and other key officers, come from small stores, mostly, that sell portable spas, chemicals, aboveground pools, toys, casual furniture and all manner of backyard items.

And while selling ancillary products to established customers helps keep the doors open at these mostly-mom-and-pop places, the steep decline in hot tub sales in recent years has hit the sector hard.

"People have been really holding off on making purchases," said one respondent. "There definitely are not as many spa leads as there were just a few years ago. People are not giving themselves the permission to spend their savings just yet."

Those potential customers willing to take on debt to purchase big-ticket items were also in short supply. Restrictive lending policies by the banking industry have hurt business, and retailers tell us it's among their chief concerns in 2011, right behind consumer confidence, which sits atop the list.

Bankers also took heat for their unwillingness to lend to dealers, a problem hot tub manufacturers have long said hampers their customers' ability to stock showroom floors and get product in front of the buying public.

"After the banking crisis in 2008, I think the banks turned to over-compensating for the errors they'd made in lending that led up to the crisis," says Richard Annis, owner of Ohio Pools & Spas, North Canton, Ohio. "They just went too far in the opposite direction, and that put undue stress onto a lot of businesses."

With money from banks less dependable, and borrowers less willing to take on debt during the downturn, retailers have turned to cost cutting. If there's an upside to this austerity that's been forced onto these backyard business operators, it's the leaner and more disciplined retail network that's likely to emerge once market conditions improve further.

Until then, retailers wait, confident, at least, that the worst is now behind them.

WHO WE ARE

As much as things have changed in recent years, one thing remains constant: spa and pool retailers rely on a broad range of products to attract new customers and keep current ones coming back. They figured out long ago that hot tub lovers like to buy big grills, for example, and that showroom floors featuring a pool table or two can keep salespeople busy during the off-season. The offerings are eclectic, and no two stores sell the exact same slate of SKUs.

Most sell chemicals and equipment, and 65 percent sell portable spas, so stores with those products are common. What's becoming less common, however, are stores selling aboveground pools, which half of survey respondents sold in 2009 but only 42.7 percent sold in 2010. This drop mirrors the manufacturing trend, which in recent years has seen the shuttering of Ovation and Delair's dropping the product to focusing on fencing.

One of the retailers we interviewed for this section told us he thought the smaller shops were under the greatest pressure. Owner-operators who wore several different hats — marketing manager, sales manager, payroll department and staff CPA — have so much to do they barely find time for the important job of brand-building, he said. If that sounds familiar, take heart, as you're in the extreme majority. More than 40 percent of retail stores have no more than a single employee on the payroll year-round and full-time. Many of those small businesses add help during the busy season, but few add more than a small handful.

How many employees do you have working in retail?

STAFFING

Given the high unemployment rate, we expected survey respondents to tell us it was getting easier to find quality workers. Few told us that. Of the 46 percent who said good help was getting harder to find, many pointed to what they viewed as a lack of work ethic among the young. Some thought the unemployed had things too easy, and lacked incentive to join the workforce. Here are some other responses:

"Seasonal layoffs make it difficult on employees with families."

"We have started to go to job fairs to get the most-eager employees. An advertisement on a Website or in a newspaper just doesn't cut it anymore."

"Our state has implemented licensing requirements on any one touching electrical and plumbing. That makes it extra hard on us."

"We can't compete with wages for waiters and waitresses; usually good kids go that direction."

"We have been looking for an additional service technician and a maintenance technician, and cannot find anybody that has the correct skills."

"We assumed the skilled labor pool from the construction industry would help our chances, but it hasn't."

What are your staffing plans for 2011?

This year's survey respondents are more likely to hire than last year's were — 31.3 percent told us they would be looking to hire in 2011. Last year, only 23.6 percent of respondents anticipated adding to their payrolls. Here's more good news: only about one in a hundred told us they planned to lay off employees.

Did you hire or lay off any employees this past year?

RESULTS

Of the survey respondents that sold portable spas in 2010, almost half sold 20 or fewer, and about a third sold 10 or fewer. In other words, it's still mostly a mom-and-pop dealer base selling small numbers of spas per store. There were some behemoths in there, too, as 17 percent sold 100 or more. These big dealers brought the group average up to 66 spas per store. The median, which is a more accurate way to measure typical store size, was 25 tubs.

About one third saw sales rise compared with 2009, most of them posting gains of between one and 20 percent. Another third saw sales drop, with a good deal of those off only slightly, but a hefty 35 percent were down by 30 percent or more.

Aboveground dealers fared similarly, though there appear to be fewer of them in the business than last year. In this group, the average is 25 pools apiece, but the median is a puny six pools. Dealers told us the inexpensive inflatable pools have taken a big bite out of business. Others told us the pools don't have the cache they once did. One aboveground dealer, however, was quick to defend the product, saying its recent troubles can be largely attributed to weather. "When the economy tightened up, so did the aboveground market, of course. But in our area, and I'd assume everywhere else, it's still weather-driven. We had a beautiful summer — as summers go in Ohio — last year, and so people were able to get a lot of use out of pools. So that really helped drive sales, regardless of the economy."

Aboveground dealers look a little more leery. Last year the survey respondents sold 2,610 pools, and next year they're forecasting 2,683, or a modest 3 percent gain.

How many portable spas did you sell in 2010?

Spa dealers seem to see some light at the end of the dark tunnel they've been in for several years: All together survey respondents expect to sell 12,325 spas, which would represent a healthy 16 percent increase over 2010. Is this evidence of spa dealers' famous optimism, or might the market be ready to reclaim some of the business it's lost in the recession?

How many aboveground pools did you sell in 2009?

UPS AND DOWNS

"Pent-up demand and better consumer confidence."

"Banks are still not lending, people are not working and high fuel prices are increasing."

WHY THE GLASS IS HALF FULL

"We have increased our selection of parts and accessories and broadened our market to encompass online sales."

"Customers are motivated after such a nice summer and they seem to be loosening up with spending money."

"We're making more floor space for patio sets, and continue to train sales staff."

"Our area has more of a stable employment picture now. Our costs have gone up, though, so there will be a trade-off."

"Prayers and some additional advertising, which I can ill afford."

"Hope."

WHY THE GLASS IS HALF EMPTY

"We're still waiting for economy to rebound. I'd be happy just to maintain status quo at this point."

"It's simple: a bad economy."

"I'm not comfortable with administration's economic-recovery plan."

ADD IT UP

This year's survey finds the retail segment of the industry particularly hopeful about the future. Among last year's respondents, fewer than half expected their retail sales totals to grow by between one and 15 percent; this year, 61 percent made that prediction. In fact, a whopping 95 percent expected sales to either remain flat or grow.

"There is still demand that has been deferred until people are sure that the economy is coming back, which it is," said one retailer.

Still, the hot tub market's sharp fall-off in the last four or five years has hit backyard retailers hard, and even if optimistic outlooks are achieved, it'll be a while before sales return to where they were. Some even discourage their fellow retailers from measuring success by the old yardstick.

Said one retailer: "This is the new normal."

What was your gross revenue for retail sales in 2010?

WHAT, ME WORRY?

The retailers who responded to this year's survey proved to be in a pretty good mood overall, most expecting business to pick up in 2011 after having a pretty decent year in 2010. Still, they're concerned about some of the root causes of the parallel downturns in the domestic economy and backyard retail industry, most specifically portable spas.

Once consumers feel better, retailers will feel better. That's been happening, but not quickly enough for most concerned, as our survey showed more retailers worried about that than anything else. The numbers are little changed from last year, suggesting that the conditions surrounding the issues haven't changed much either. Consumer confidence may have upticked, but bankers are still sitting on stores of cash and the hands and tools of the homebuilding industry remain largely idle.

"We gained market share by 20 percent because one of our notorious stack-them-deep-and-sell-it-cheap spa dealerships finally went under. He always was selling his products too cheap to cover his overhead," said one respondent.

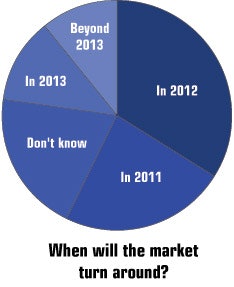

When do you see the market turning around?

HEATED RIVALS

"We originally had the customers, they left for the new guy, then came back after figuring out the new guy was full of you-know-what."