This economic recovery (now in its 90th month) is the third-longest, and most ignored, expansion on record. By calendar standards it seems to be "late in the game," but we may well go into "extra innings." As Jim Paulsen, chief investment strategist at Wells Capital Management, notes, "In this recovery, companies have never overstaffed, overbuilt or over-inventoried."

We still don't see the telltale signs of a stretched recovery or a looming recession. Interest rates remain historically low and there has been no mad rush to buy houses. Additionally, investor interest/enthusiasm remains quite tame. On a personal note, I am rarely asked for stock ideas at cocktail parties or crawfish boils!

Economically, the stars have aligned for the pool and hot tub industry. I personally believe the financial markets serve as excellent leading economic indicators of consumer confidence. This measure is now at a 16 year high. Not only is the stock of PoolCorp (POOL) at all-time highs, but other consumer confidence-related stocks such as pleasure boat maker Marine Products Corporation (MPX) and Airstream trailer manufacturer Thor Industries (THO) are also at or near multi-year highs.

Another economic indicator for this industry is housing. Both new housing and existing housing upgrades are very strong. Again, you can see this in the soaring share prices of homebuilder D.H. Horton (DHI) and home improvement retailer Home Depot (HD).

Finally, global warming will be a positive for the pool and hot tub industry as more geographic areas become viable for outdoor pools, hot tubs and outdoor living in general. NASA has reported that 16 of the 17 hottest years ever have occurred since 2000.

Plenty Of Juice

Over the past decade investors have stopped talking about "peak oil" (or the hypothetical time in the future when oil production reaches an all-time high, followed by a decline) and have instead begun worrying about peak demand. Shell Oil believes that world oil demand may peak in 2020. Saudi Arabia is banking on 2030 for a top. And the International Energy Agency thinks it's beyond 2040.

It's estimated that 70 percent of all oil is used for transportation, and the growing viability of electric vehicles may rattle long-term investors in energy. Ford Motor Company says 40 percent of its models will be electric by 2020 and Volkswagen, Mercedes Benz, and BMW all plan to stop making internal combustion engines by 2030. Fuel availability seems like a big deal, but it is really just a chicken and egg issue.

Click to enlarge

Click to enlarge

Currently (no pun intended) the electric car only has 1 percent of the automotive market, but it's growing quickly. So, where's this new electricity going to come from? Coal has dominated electric generation for a very long time, but now natural gas actually produces more electricity. Almost all of the new power plants built in the last decade have selected natural gas as their fuel.

Want to see further evidence of natural gas leadership? Take a trip to the liquefied natural gas transport facilities in and around Lake Charles, La., about 200 miles southwest of New Orleans. Here, billions of dollars are being invested in facilities and ships that take plentiful, domestically produced natural gas and export it to other countries where the fuel commands a higher price.

Rebuilding The American Dream

I frankly have a front row seat to the U.S. economy. In our student stock research program at Tulane University, Burkenroad Reports, I speak with dozens of top executives and as the host of the weekly business program on NPR, "Out To Lunch." I break bread with about 100 business folks each year. Their single greatest concern is finding and keeping qualified workers. They also talk to me about rising labor costs.

References:1 Money.com 2 Fortune Magazine |

Unemployment is at a 10-year low and consumer confidence is at a 15-year high. Then why the economic backlash? It's because the vast majority of these benefits have been collecting in the pockets of the very well off. Surveys show that more than 70 percent of Americans feel that our economic system is rigged.¹

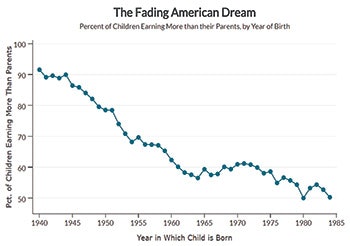

Of Americans born in 1940, more than 90 percent were in fact doing better than the previous generation.² But this has declined each succeeding decade, and only about half of people born in 1980 could make the same claim. I think this may be the ultimate financial yardstick.

Investors seem to like a lot of President Trump's proposed policies, especially the idea of a significant cut in the corporate tax rate. This benefit would go straight to the bottom line and raise a company's all-important earnings per share.

Analysts now feel that EPS on the S&P 500 will soar by about 20 percent to a gaudy $130 in 2017. These same lower rates are also expected to bring trillions of dollars held abroad by multi-national corporations back to the U.S.

All of this is probably true, but it won't provide much of an economic boost (jobs) if companies elect to continue putting these new monies into mergers and acquisitions and stock buybacks. Corporate earnings have been terrific since the recovery began in 2009, but very little of it went to (job-creating) capital expenditures.

Some have likened today's post-election enthusiasm to the 1980 election, when pro-business Ronald Reagan was elected. But, before this comparison turns you into a born-again bull, remember that stocks fell 19 percent in the 18 months after Reagan's inauguration. One big difference, of course, is that Donald Trump inherits a much better economy than did President Reagan.

Peter Ricchiuti is director of research for BURKENROAD REPORTS, a securities research program in which 200 students meet top management, visit company sites, publish and distribute investment research reports on 40 small-cap companies in six Southern states. He has been featured in Baron's, CNN, New York Times and the Wall Street Journal.