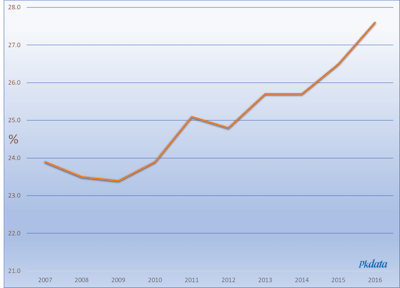

Today, nearly one and a half million pool households use a professional pool service for routine maintenance such as adjusting chemicals and equipment upkeep. That's over a quarter of all inground residential swimming pools in the U.S. and the penetration percentage continues to grow.

Opportunities abound. But so do the challenges.

The Expanding Pool

Like the rest of the industry, the pool service business took a hit during the recession. Since then, however, the percentage of pool households using a regular service has increased by 4.2 points, or more than 200,000 households.

Exhibit 1: Pool service penetration as a percentage of U.S. inground pool households, 2007-2016.

Source: Pkdata surveys of pool owners and pool service firms.

As this column has pointed out in the past, one of the "cleansing effects" of a major economic downturn is that it tends to drive many weaker firms out of business. Those that do survive usually have stronger balance sheets. This is usually when industries enter a period of acquisitions, such as we are seeing now within the pool and hot tub segments.

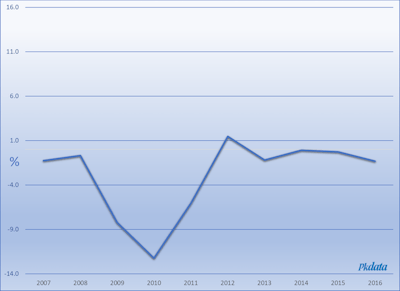

One consequence has been consolidation within the service segment, which has apparently led to more competitive pricing as firms seek to leverage market share, presumably through increasing scale. The attendant effects can be seen in Exhibit 2, below.

Exhibit 2: Percent change in annual pool service revenue per household, 2007-2016.

Source: Pkdata surveys of pool owners and pool service firms.

Taken collectively, the two exhibits say that while there are more households than ever enjoying regular professional pool service, they are also paying less for that service.

One might rightly question the very logic of consolidation in a business like pool service in the first place. While some back-office functions can be combined to the benefit of cost savings, the essential nature of the business is unchanged, namely the time, mileable, vehicle depreciation and, most of all, labor involved in every service call.

While automation and remote monitoring are changing the pool service dynamic, most of that change is happening on the commercial side of the business. Home automation, such as we are seeing with smart controls on HVAC, lighting and home security, is only just beginning to have some impact within the pool/spa segment. As automation does expand within this industry, will it accrue to the benefit of the service business — or perhaps obviate much of it?

It's an intriguing question.

Pkdata is an Atlanta market research firm that has tracked the residential and commercial pool and spa industry since 1992. To date the firm has completed over 400 studies among consumers, manufacturers, dealers, builders and service companies. Its annual industry statistics reports are widely used as planning tools by principal stakeholders globally.