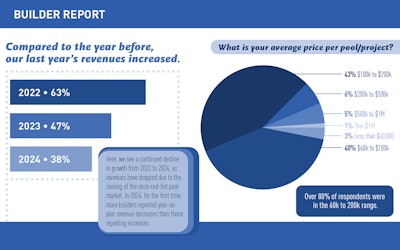

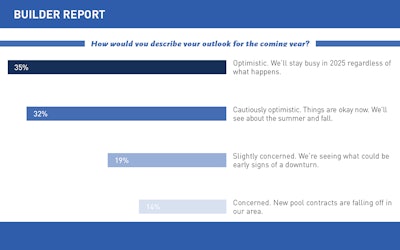

For a while there, from 2020 to 2022, backyard builders seemed to have the world's disposable income all to themselves, and couldn't build enough pools to sate the demand. But that was never going to last forever. Travel slowly got back on its feet, boats and RVs revved back up, and as those competitors took back their share of consumer luxury spending, the pool building market has come back to Earth. Our market remains strong by historical standards, but has become more competitive. The voices in this year’s report detail that state of affairs.

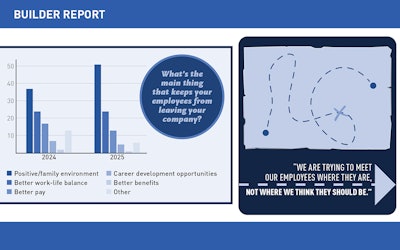

Labor

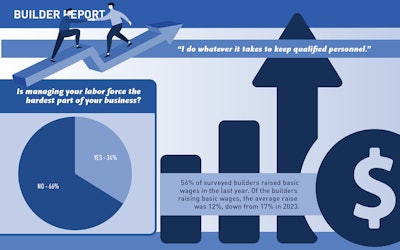

Labor remains a major issue for construction companies. Construction companies use a variety of strategies to maintain their workforce, including promoting a better working environment and rewarding employees with cash.

Operations

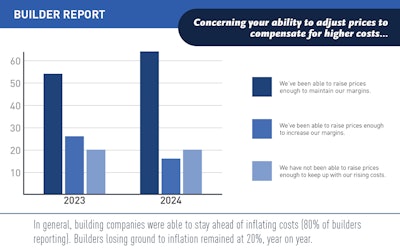

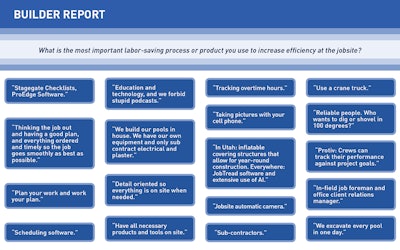

Technology continues to shape the jobsite as computers/smartphones add intelligence to the supervisory role. Builders cited a wide variety of factors that are influencing the daily operations of pool building. All this takes place before a backdrop of rising prices and attenuated demand.

This report is sponsored by Lyon Financial!

Joe Garcia | Sr. Business Development Manager, National Sales | Lyon Financial

Joe Garcia | Sr. Business Development Manager, National Sales | Lyon Financial

AQUA: What trends in financing are you anticipating for 2025?

Joe Garcia, Lyon Financial: Pool buyers are increasingly looking for longer loan terms — up to 30 years, exclusively available through Lyon Financial — making it easier to secure low, predictable monthly payments that fit their budgets. There’s also a growing interest in funding entire backyard makeovers, including landscaping and outdoor kitchens, leading to larger loan amounts becoming the norm. We’re also seeing a clear preference for unsecured loans over traditional HELOCs. Customers want a faster, more streamlined process — with fixed payments and no need to leverage home equity. Flexibility, speed, and simplicity are now paramount for closing the deal.

AQUA: What makes Lyon Financial stand out in the pool financing industry?

JG: Lyon Financial distinguishes itself in the pool financing space because of our personalized approach, decades of industry expertise, and commitment to customer experience. We’ve been exclusively focused on pool and outdoor living financing for over 46 years, allowing us to develop a deep understanding of both the pool industry and pool buyers’ unique needs. Our reputation is built on treating customers like family. Builders can confidently recommend us, knowing we’ll provide each pool buyer with the same level of care and attention they would offer themselves.

AQUA: How can builders better leverage financing options to close more sales or upsell premium features in the coming year?

JG: Financing is a powerful selling tool and builders should introduce it early in the conversation with pool buyers. Presenting long-term financing options during your first meeting shifts the focus from, “Can we afford this?” to “How big can we dream?” With fast approvals, a simple application process, and personal customer support, you’re giving your clients a seamless path from vision to reality — and positioning yourself as a fullservice, one-stop solution. Always keep financing top of mind in your marketing by including your finance partner in your advertising, social media, website, and even your email signature.

AQUA: What financing tools/support will Lyon Financial offer in 2025 to help builders streamline the process and improve customer satisfaction?

JG: Our most powerful tool is our loan calculator — it allows builders to present affordable monthly payment options during sales conversations. We’ve rolled out a new builder portal that allows for real-time loan status updates to help keep your projects on track and moving forward seamlessly. Builders can count on ongoing support from a dedicated team that understands the unique challenges of the pool industry — backed by the peace of mind that comes from partnering with a company known for its exceptional customer service. Whether it’s assisting your clients through the financing process or answering your questions quickly, we’re here to act as an extension of your team — not just a loan option.