In 2007, the pool building business hit a high-water mark, with approximately 180,000 new pools put into the ground. A year later, the housing market collapsed and plunged the nation into a deep recession. Sales slumped. Builders went bust.

The stronger builders found their footing and continued installing new pools, though in smaller numbers. After five years of slow, post-recession growth, last year builders only installed around 55,000 inground pools in the United States.

A crucial goal in the effort to increase the sales of pools and aftermarket products is to define the current pool market environment and understand the perceptions of both owners and non-owners.

A crucial goal in the effort to increase the sales of pools and aftermarket products is to define the current pool market environment and understand the perceptions of both owners and non-owners.

It's been taken as an article of faith that the economy is to blame for the meager rebound, but the economy has seen a steady, if shallow recovery with shrinking unemployment and a relatively good home-construction market. On top of that, sales for competing industries — RVs, boats, vacations — have fully recovered and are now at pre-recession levels. Why, then, have pool sales lagged?

To find out, APSP teamed up last fall with Gallup, a leading consumer research firm, to survey consumer attitudes about swimming pools. The company garnered more than 1,500 completed surveys from people who said they'd purchased a pool within the last five years, and more than 2,500 from people who didn't own a pool but made at least $75,000 annually.

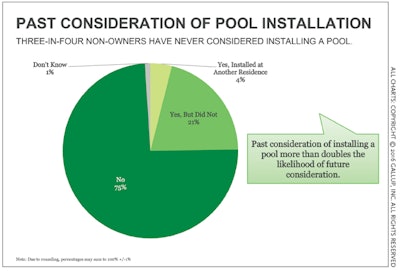

This chart shows the responses of consumers that could likely afford a pool, but do not own one. Three out of four had never considered the purchase, which represents both a public perception problem and a market opportunity.

This chart shows the responses of consumers that could likely afford a pool, but do not own one. Three out of four had never considered the purchase, which represents both a public perception problem and a market opportunity.

The survey questioned respondents on their attitudes toward pools as compared with competing products, identified key attributes that attract buyers, the socioeconomic and demographic differences between buyers and non-buyers and more. With nearly 60 questions on each survey, the result is a data-rich picture of how today's consumers view pools.

"For a long time we've been focused on our big competitors and trying to figure out why some people bought their products and not ours, but we haven't really gotten good answers," says Rich Gottwald, president and CEO of APSP. "We hope this research will help us and our members understand the motivations behind purchasing — and non-purchasing.

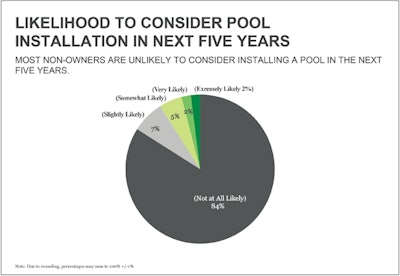

Likelihood to consider purchase: Here we see the same group of non-owners that had never considered a pool retaining that stance, joined by 9 percent of the group that had considered the purchase.

Likelihood to consider purchase: Here we see the same group of non-owners that had never considered a pool retaining that stance, joined by 9 percent of the group that had considered the purchase.

"Our members are going to use the information in this report to compare with other data points, as will we. We'll be looking at the messaging that we're using in the ESCAPE campaign to see how they're matching up with what we're hearing from consumers, to see how we can tweak things — or even overhaul them — to improve our message. In some cases we can cater marketing to meet what we learned consumers are after, and in other cases we can work to dispel misconceptions about energy or safety uncovered in the survey.

For an example of a group that APSP wanted to better understand, Gottwald points to millennials, a loosely defined group of young adults that are now entering potential pool-buying age.

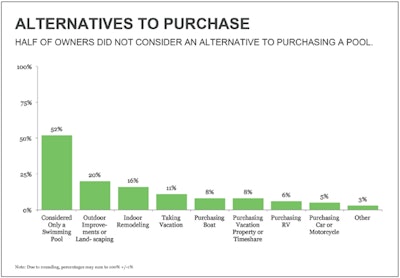

This chart shows the responses of consumers that currently own a swimming pool. While half of them never considered anything else to use the money on, 20 percent thought about outdoor improvements and 16 percent were eyeing remodeling projects. Only a small percentage looked at boats or RVs.

This chart shows the responses of consumers that currently own a swimming pool. While half of them never considered anything else to use the money on, 20 percent thought about outdoor improvements and 16 percent were eyeing remodeling projects. Only a small percentage looked at boats or RVs.

"We need, I think, to step up our game in talking to this age group about our products, and the value those products bring to their lives," he says. "For example, if it's true millennials cherish experiences over possessions, which you read and hear about in the media, we can tailor messages to address togetherness with family and friends, and the idea of 'staycations' instead of vacations.

"We want to know where they want to spend their time and money, and where they want to live. I think all of those issues come into it. We're looking for a clearer understanding and seeing how we can play into that conversation when these issues come up."

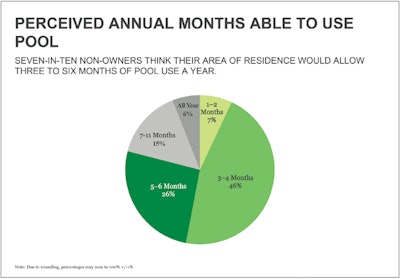

This chart shows the responses of consumers that could likely afford a pool, but do not own one. Part of the reason is likely that over 50 percent of these non-owners regard their swimming season as 4 months or less.

This chart shows the responses of consumers that could likely afford a pool, but do not own one. Part of the reason is likely that over 50 percent of these non-owners regard their swimming season as 4 months or less.

Of course, millennials are only a small portion of the potential pool-buying public, and consumer marketing is only a small portion of what the association does.

"First and foremost, this is about protecting our members and helping create an environment in which they can grow," Gottwald says. "The biggest thing we do is still lobbying at the federal, state or local level around energy and safety issues.

"But the recession was such a major event for the industry, it forced us here at APSP to ask ourselves if we could help move the needle. That's what we've been doing with ESCAPE, with the lending program through Prosper, and that's what we're doing with this research. We want to reintroduce our products to the consumers and get them to think, 'Yeah, I really do want that in my backyard.'"

Nine APSP member firms paid for the Gallup survey of consumer attitudes toward pools, the basis for this article. It is now available for purchase in its entirety. The full APSP Gallup Report Research Project is available for $15,000, and separate reports focusing only on pool owners or non-owners are available for $7,500 each.

Contact Lisa Grepps, [email protected] for details.

Is Business Getting Better? You BetSales of inground pools in 2015 were less than one-third of what they were in 2007. But the numbers are improving Rich Gottwald, president and CEO for APSP, is bullish about the future of the pool building industry. Sure, sales last year pale in comparison to those during the building boom, but they are improving, and last fall's new consumer research, marketing and financing initiatives provide reason for optimism. "The numbers might not look great, but the industry is on the upswing. There is no doubt about that," he says. "I've traveled and talked to our members and non-members, the manufacturers that supply the builders, and everybody, and I mean everybody, says we are on the upswing. Now, will we ever get back to that pre-recessional level? Probably not anytime in the near future. It looks to me like those numbers were just not sustainable. But for those who survived the downturn, I think they came out of it stronger and can also look forward to bright days ahead." |