Are pool stores closer to their pool-owning customers than mass merchants (like Walmart)? Pkdata takes a look.

In retail, they say, location is everything. That would have to be especially true for pool stores. All other things being equal, would you rather have your pool store located within 10 miles of 5,000 households in Connecticut or Arizona?

The answer isn’t as obvious as you think.

RELATED: Case Study: Which Store Has the Better Location?

Based solely on weather, Arizona would seem to be the logical choice. Its nearly year-round summer climate is the perfect setting for a backyard pool. And as it turns out, Arizona does have a higher percentage of households with inground pools, 16.9 percent. Compare that to Connecticut’s 6.1 percent.

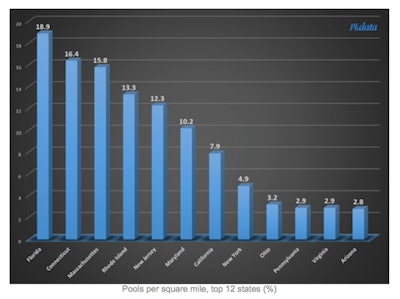

But guess which of the two states has more inground pools per square mile? Connecticut’s 16.4 pools per square mile is way ahead of Arizona’s 2.8. How can that be? Connecticut is a comparatively small state with a large population, thus it has much less dispersion than Arizona with its wide-open spaces — even though Arizona has four times as many pools as Connecticut. In fact, Arizona only ranks 12th in terms of pools per square mile.

So maybe it’s time to rethink that new location in Tuscon? (Actually, no — Tuscon ranks 25th in the country for total pools, over half as many as the entire state of Connecticut. It also ranks 35th out of 906 MSAs in terms of pools as a percentage of all households — not a bad combination.)

Which channel is most efficient?

Our original question was, which retail channel — specialty pool and spa retailers, mass merchants, DIY centers or wholesale clubs — has the greatest average proximity to swimming pool households?

The image above looks like one of those shots of the U.S. seen at night from space. But it’s actually 14,004 stores that carry backyard pool products. That includes not only specialty retailers in the industry, but also Walmart, Home Depot, Costco and more.

If you were to draw a 10-mile circle around every one of those locations and then sumarize the average count of pool households by channel, this is what you would get.

This shouldn’t come as a huge surprise because, after all, pool stores primarily serve one specific audience while mass merchants and their ilk serve everybody. And, in fact, if you were to sort every store that carries pool products in order of greatest 10-mile proximity to pool households, you would go through 134 specialty retailers before you got to the first general merchandise retailer, a Lowe’s in Orlando.

But before we all get too smug, it also turns out that the bottom two stores, out of 14,004, are also specialty retailers, both located in towns you’ve probably never heard of, somewhere in the Midwest.

Mass cannibalization

Another measure of efficiency is cannibalization — the degree to which trading areas overlap. One way to calculate this is to sum the pool counts within a 10-mile radius of every store within a given chain or channel. For example, Walmart’s nearly 4,000 U.S. stores collectively serve some 24,600,000 pool households. Since there are only 5,163,000 residential inground pools in the U.S. as of the end of 2016, that means Walmart is proximate to almost five times as many pool households as there are actual pools. But Walmart isn’t a pool store, so they likely don’t care.

Want More Data?To learn more about the pool industry, check out Pkdata's 12th annual U.S. Residential Swimming Pool Market Report, which features detailed analysis of all aspects of the residential inground and aboveground pool business. To learn more, click here. |

Cannibalization isn’t as much a problem with pool stores because they are so specialized. While it isn’t unusual for multiple specialty retailers to be within 10 miles of each other, they usually aren’t the same brand.

RELATED: How Important is Your Store's Location?

Twenty years ago, when “big box” retailers expanded their pool product offerings, some predicted the demise of the independent pool store. That hasn’t happened, for many reasons, and today most of the larger retailers have shrunk their pool-related planograms.

Pool stores exist to serve a specific audience and they do it very well. Of course, video rental store and music stores also used to serve a specific audience and most are no longer around. The big difference with stores serving this category is pretty simple: You can’t download a swimming pool.

This story was reprinted with permission from Pkdata. Pkdata is an Atlanta market research firm that has tracked the residential and commercial pool and spa industry since 1992. To date the firm has completed over 400 studies among consumers, manufacturers, dealers, builders and service companies. Its annual industry statistics reports are widely used as planning tools by principal stakeholders globally.