Inground pool construction peaked at 176,000 new units in 2005 but dropped to only 55,000 in 2014. According to P.K. Data, an authoritative source, there is potential for 288,000 new inground pool units each year!

So why aren’t we selling more? When qualified prospects were asked why they hadn’t shopped for a new pool in the past two years, 34.8 percent said, “Haven’t thought about it.”

With increasing competition for discretionary spending, inground swimming pools have lost consumer awareness. We seem to be missing promotions that reach people who are both qualified and inclined to buy a pool.

And for good reasons.

Traditional advertising methods don’t work very well.

Traditional ads don't reach enough potential prospects and waste money on unqualified audiences. Think of advertising as a way to get your message communicated to as many new qualified pool prospects in your trade area as possible. Everything else being equal, it is always preferable to impact more prospects rather than less.

But with 55,000 inground pool sales per year out of 114 million non-pool households, there is a very low penetration of potential customers. That means only 0.05 percent of the average households across the U.S. will buy a swimming pool in any given year. And only 5 percent already own a pool.

So it shouldn’t be surprising that traditional advertising methods such as broadcast, print and outdoor are extremely inefficient. Using them is like being in a dark room searching for a black cat that isn’t there! For the pool and spa industry, traditional advertising has a waste factor between 95 and 99 percent!

Expectations may be too high for online advertising.

Use it to complement other methods but understand the limitations. Pay-per-click online advertising is associated with finding business information, almost like the Yellow Pages. It’s a passive, “sit back and wait until a consumer is already interested” approach and sets off a round of comparison-shopping against others on the search page results.

It also has its limits. We analyzed one retailer/builder's Google AdWords campaign and found it only reached 8 percent of the target market with a very substantial cost. It may be controversial, but I believe that over-prioritizing digital media could actually have a negative effect on growth in this industry.

Email has some pretty significant limitations.

Email marketing is in the spotlight at the present, however that doesn't make it the best option for every audience. For example, we found that most pool retailers have email addresses for less than 25 percent of their customer base. And most builders have very few, if any, qualified inground pool prospect email addresses. By relying on email, you could be missing 75 percent or more of your target market. And considering that only 22 percent of retail consumers open emails and 3 percent click through to a website, email reach is very poor.

Is there overreliance on word of mouth?

Some 30-pool-per-year builders have told me that “word of mouth” has worked as their sole advertising for a long time. But simply sticking to the same strategy without any reevaluation is risky — the bankruptcy landscape is littered with companies who stuck too long to the status quo. Word of mouth is an important ally, but it’s opportunistic in nature and can’t create recall in people who have never heard of your company. Plus, larger builders must generate ever-increasing quality leads to fill the pipeline and support overhead.

Instead, what we need is a cost-effective way to identify and reach more high-quality prospects. We set out to do just that.

The Solution

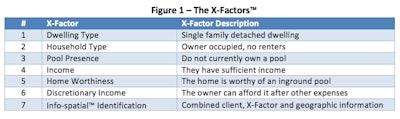

To begin, we analyzed 3,678,857 inground pool owner records to develop a meaningful profile of the most likely inground pool prospects. We arrived at seven characteristics that were consistent across most pool owners, which we labeled them the “X-Factors.” (See Figure 1).

Next, we applied these X-Factors to a database of more than 239 million consumers nationwide, creating the X-Factor list: the names and addresses of 7.1 million prospects who are most qualified to purchase a new inground pool. As a result, we know who these prospects are, where they live, and how to reach them with direct mail.

This is a resource-based index of household spending capacity rather than strictly a measure of available assets. The definition of discretionary income is the amount of household cash flow that remains after subtracting taxes, home mortgages, food, education, transportation and other day-to-day cost of living. So when it comes to luxury purchases like pools, spas and weekly maintenance, not only do we consider household income and home market value, but we also consider the ability to pay for new luxury items.

What is Info-spatial Identification?

We use this term to describe the extremely important step of “dialing in” prospect profile information in combination with characteristics of a specific trade area. Pool prospects are identified in relationship to local X-Factors; the profile of a builder’s actual customers; drive-time analytics; competitors; geographic constraints such as rivers, mountains and highways; and builder objectives. All the information is brought together to create a geo-spatial map of the names and addresses of the most qualified inground pool prospects.

Why should anyone believe the X-Factors work?

Besides having a solid scientific basis, we tested the X-Factors against 905 actual pool permits issued in the city of Dallas, Texas, over the last two years. Both the new owner profile and the geographic locations matched X-Factor projections with 99 percent accuracy. For example, Figure 2 shows the location of the top 62,986 inground pool prospects in the 13-county Dallas–Fort Worth metroplex.

Figure 2 – Inground Pool Prospects by Zip Code, Dallas – Fort Worth metroplex

Rethinking direct mail

It is easy to get mentally swept away by the digital world. But there is value in re-thinking existing communication models based on the development of Xmente’s intelligent, evidence-based address lists. With almost 100 percent reach and an average open rate of nearly 80 percent, direct mail is clearly the optimum choice. No digital or traditional mass media method can approach that. Those who are not using direct mail because they believe it is dead are missing a huge opportunity. Maybe it is time to start zigging while everyone else is zagging.